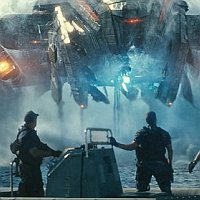

Battleship, the latest Hasbro big thing

With plethora of upcoming excitement especially for Transformers new toylines in 2012, Hasbro has been seen as pretty aggressive in sticking to it’s roots of being well known for making toys and games based on movies and TV shows.

Lately, the multinational toy company has been making movies and TV shows based on its toys and games.

After becoming an entertainment powerhouse with its Transformers movie franchise, which grossed $2.6 billion worldwide, and a G.I. Joe movie ($302 million worldwide gross), Hasbro has big plans this summer for a G.I. Joe sequel and a new movie based on its Battleship board game.

The company also recently announced plans for a live-action movie based on Stretch Armstrong, a toy that gained popularity in the 1970s, and it is in talks to develop a movie based on the board game Candy Land starring Adam Sandler.

To expand into television, Hasbro formed a production company, Hasbro Studios, and joined with Discovery Communications in 2010 to create the Hub, a

TV channel with programming based on Hasbro toys and games. Ratings have been steadily

increasing; the number of viewers grew 16 percent in January over the same period the year before.

The idea was to expand on Hasbro’s most popular properties.

“It’s a core-brand strategy,” said Brian Goldner, Hasbro’s chief executive. “We asked which brands have the potential to be reinvented and reignited.”

The strategy extends to new properties, too. Hasbro is using Toy Fair, the international gathering of toy makers that started Sunday in New York, to reveal its latest franchise, Kaijudo, a trading card game, online game and animated TV show.

Wizards of the Coast, a Hasbro subsidiary, worked with Hasbro Studios to come up with a concept that integrated physical gaming with a digital experience and a rich story line.

“It’s a fantastic example of Hasbro’s branded-play strategy,” said Greg Leeds, the president of Wizards of the Coast. “It offers immersive entertainment across a variety of platforms.”

Hasbro is ahead of its competitors with its brand strategy, said Reyne Rice, a toy trend expert.

“By investing in their own properties, they are making the company more profitable,” she said. “It becomes a revenue stream for them in the form of royalties from licensed products.”

The evolution of Hasbro’s business model began in the late 1990s. The company had a strong franchise in the 1980s with the Transformers, which included an animated TV show, comic book and toy line, but the brand had been dormant for a few years and was ripe for a revival.

“The art of assembling those elements had dissipated,” Mr. Goldner said. “We brought that back.”

Hasbro pitched the idea of a live-action movie, but it took a while to win Hollywood over, Mr. Goldner said. Eventually, Steven Spielberg signed on as an executive producer, and Paramount Pictures agreed to distribute the movie. The first Transformers movie, released in 2007, made more than $700 million worldwide.

Lately, Hasbro has moved its franchises beyond movies and television. The latest Transformers video game, Fall of Cybertron, will be released in the fall, and a 3-D thrill ride is set to open in May at the Universal Studios Hollywood theme park.

Hasbro still maintains licensing partnerships with outside entertainment properties. Among the biggest are Lucasfilm’s Star Wars franchise and Marvel Entertainment, which is releasing two major summer movies this year, “The Amazing Spider-Man” and “Marvel’s The Avengers,” both to be represented in the toy aisles by Hasbro.

Paying those licensing fees creates an added expense, but Hasbro does not have that problem with the intellectual properties it owns.

“Our four movies made $3 billion at the box office,” Mr. Goldner said. “But we made $1.6 billion in sales of merchandise because we own the I.P. and all the merchandising rights.”

-NYT